As mentioned in my quick summary, like most Kenya banks, Credit Bank doesn’t allow users to trade cryptocurrency directly on their platform, due to the complexities with setting up a cryptocurrency exchange and comes with regulations and extra work for the banks.

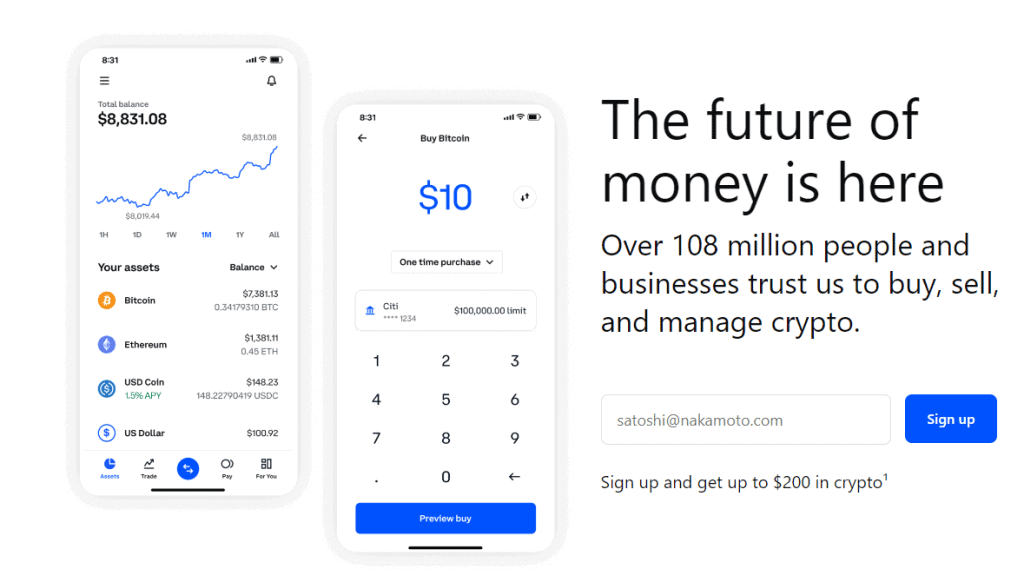

Thankfully there are many cryptocurrency trading platforms to pick from that allow you to buy Bitcoin and other cryptocurrencies.

Once you’ve signed up to a crypto exchange (in our example I’ll be using Coinbase as it’s a highly trusted and global exchange), you can easily move money from your bank account to the trading platform., and exchange it for a variety of cryptocurrencies.

How to buy crypto or bitcoin with Credit Bank

Let’s get started! Just follow our 4 quick steps.

1. Pick a cryptocurrency trading platform

As mentioned above, I’ll be using Coinbase for this guide as they are a widely used exchange and have a huge range of cryptocurrencies to choose from. It’s also one of the best exchanges for beginners and allows more advanced features when you get more comfortable with trading.

The steps in this guide should be similar for most trusted crypto exchanges, so feel free to use whichever you end up going with.

Let’s get started!

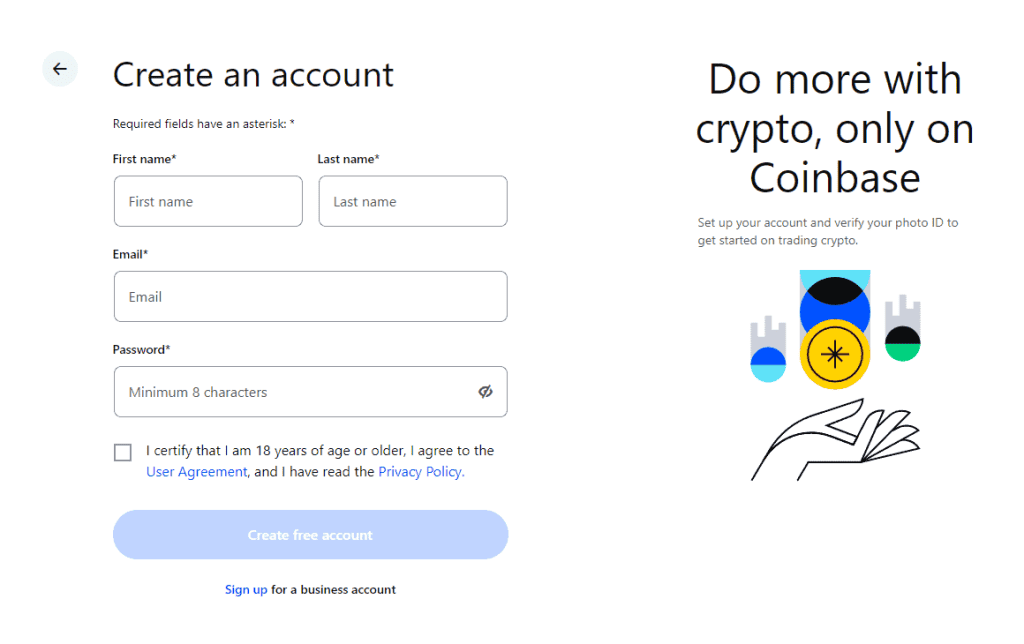

2. Create account with the trading platform

You’ll first need to create an account if you haven’t already, you can do using this quick link below.

Once you’ve filled out the basic information you’ll be asked for KYC (Know Your Customer) information, this is normal for crypto exchanges to stop any bad activity. This will often be called the “verification” process.

3. Fund your account

Next, you’ll need to add funds to your account using any of their deposit methods. For Coinbase there are many options such as bank transfer, PayPal, credit/debit card, and many more.

4. Buy crypto

Lastly, you’ll need to go to the “trade” section, this will differ for each exchange but it will usually have some variation of this.

It’s that easy! You’ve now got the tools to buy your first cryptocurrency with Credit Bank.